What is Manulife Asia Care Survey?

Started in 2020, Manulife’s Asia Care Survey is an annual research study that explores the evolving behavior, sentiments and priorities of people from eight markets in Asia (Mainland China, Hong Kong, Indonesia, Japan, Malaysia, Philippines, Singapore, and Vietnam) against the backdrop of volatile economic and sociopolitical realities impacting their financial goals, aspirations, and overall well-being.

This year's survey findings reveal a significant shift in priorities among consumers, emphasizing quality of life over lifespan. Filipinos surveyed prioritize health and financial independence to enjoy a better life over merely living a long, illness-free life. The survey also highlights the perceived importance of financial stability in maintaining overall health and quality-focused longevity. This underscores the importance of wellbeing in physical, mental, social, and financial aspects.

This evolving definition of longevity highlights the need for proactive engagement and support to help individuals make informed decisions and adopt behaviors aligning with their life goals. The survey also reveals a variety of approaches to planning for the future, indicating a broader opportunity for collaboration in guiding and empowering consumers to track progress and achieve a fulfilling, independent lifestyle in their later years.

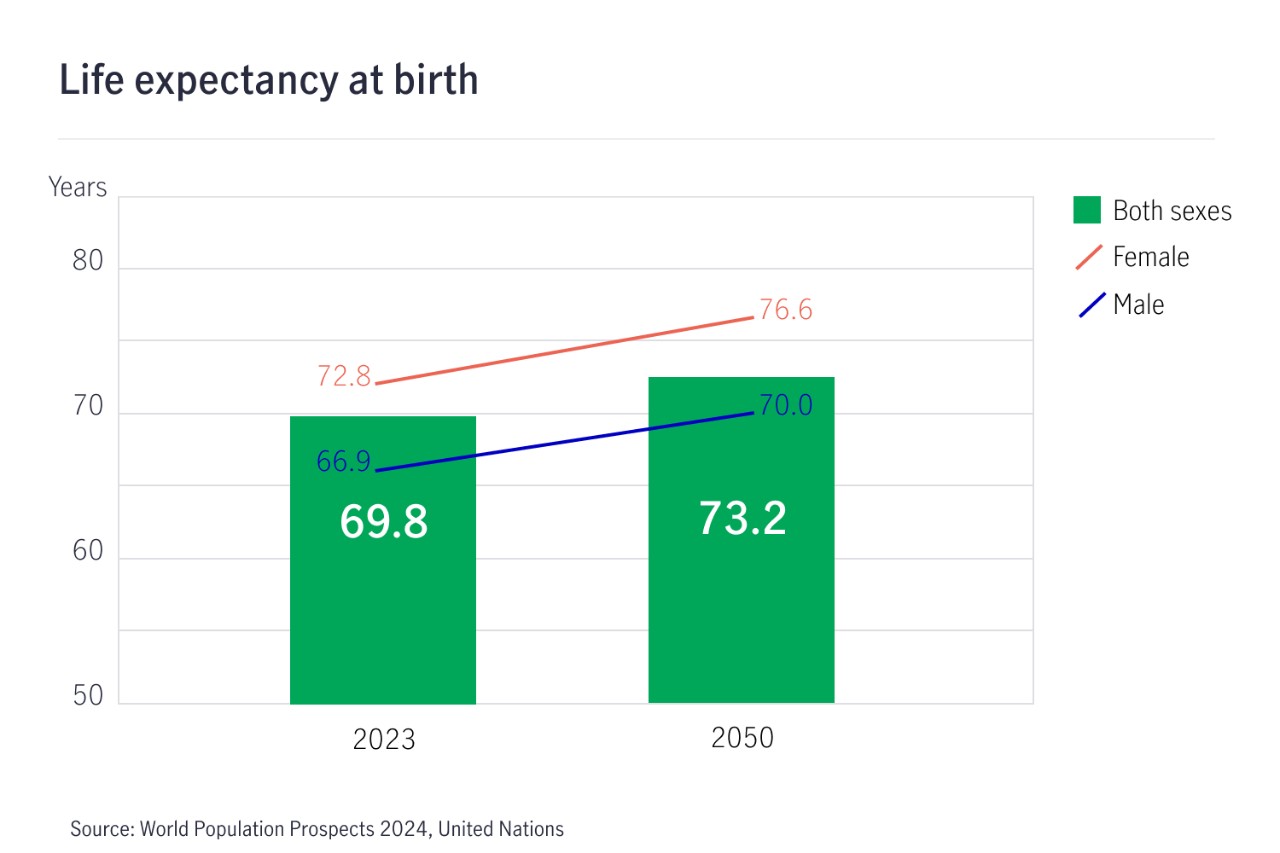

This year’s Asia Care survey asked 1,000 Filipinos about their views on longevity. In the Philippines, life expectancy at birth is projected to reach 73 years by 2050, from 70 years in 2023. As people live longer, they start viewing longevity from a different lens, which focuses on meeting their own needs and priorities.

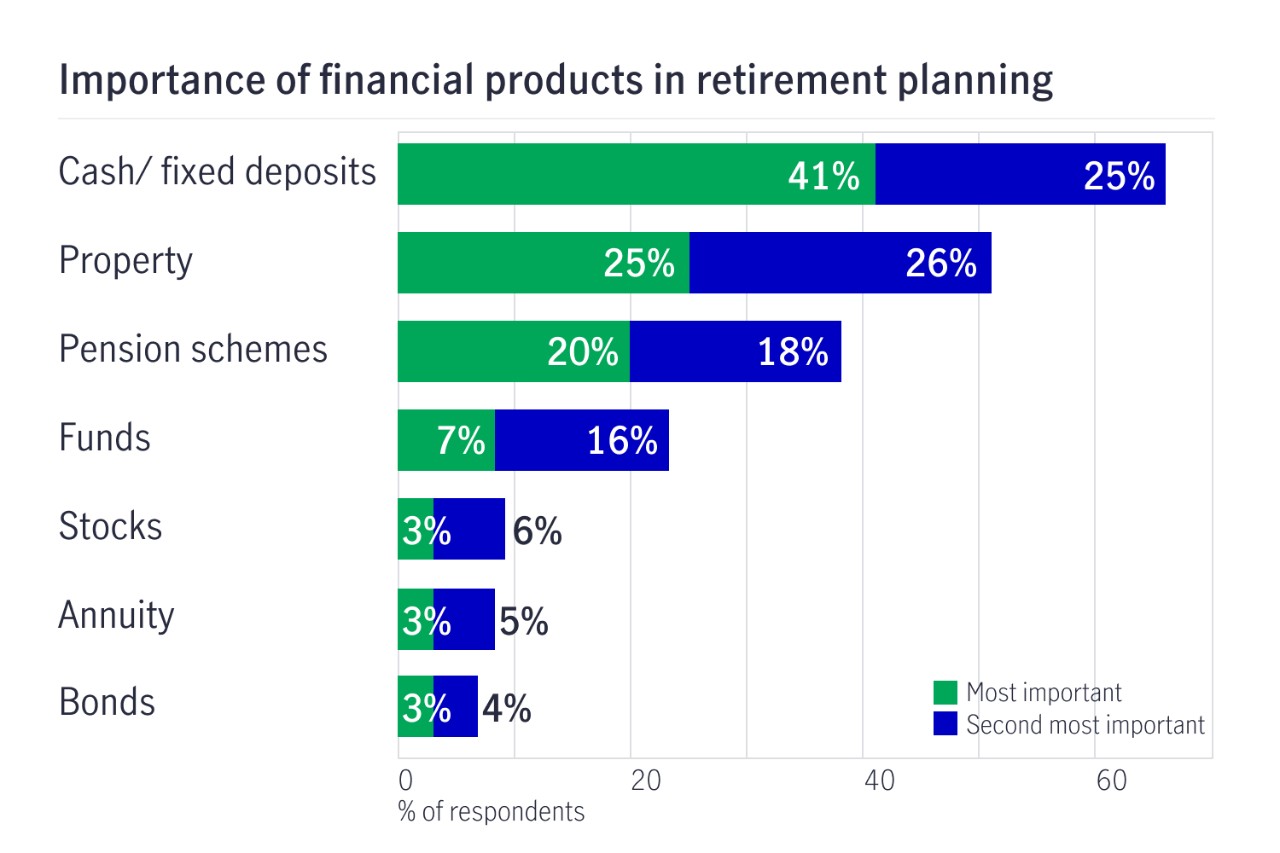

For Filipinos’ retirement planning, cash and fixed deposits remain king. The survey found that 66% view keeping their money in cash or fixed deposits as one of their top 2 priorities, while 51% express they want to invest in property. However, more than half (54%) also expressed a desire for steady income streams during retirement—something that cash-heavy portfolios may not be able to provide, especially in the face of inflation and rising healthcare costs.

The study found that it is evident that having help from professional financial planners can make a huge difference in people’s financial readiness for retirement. The value of professional financial advice is also apparent: 70% of those who work with financial planners believe they will have enough funds for retirement, compared to only 38% of those without such guidance.

Supporting Filipinos' fresh definition of Longevity

As Philippine life expectancy continues to increase in the coming years, the need for comprehensive health and wealth planning becomes more important than ever.

"The message from Filipinos is clear—they want to age with dignity, maintain their independence, and have the financial freedom to do what matters to them," said Rahul Hora, Manulife Philippines President and Chief Executive Officer. "At Manulife, we are committed to evolving our products and services to support this vision. That means offering solutions that go beyond medical and critical illness coverage to address health protection needs and offering investment options that can provide reliable income streams for a better, more fulfilling life.”

For the Asia-specific data version, please visit this link.

What can you do?

The Asia Care Survey 2025 reveals a clear connection between financial well-being and overall quality of life, particularly in retirement. While many people in Asia recognize the importance of financial health, gaps in preparation remain, with many feeling uncertain about their ability to sustain themselves during their later years. This is where proactive planning and informed financial decisions become critical.

Achieving a better quality of life in retirement begins with taking deliberate steps today.

- Diversify your investments: Relying solely on cash or property may no longer be the safest or most effective investment strategy. Move beyond the traditional mindset of ‘cash/property is king’ and consider broadening your investment approach to achieve your desired lifestyle in retirement.

- Create sustainable income streams: Explore alternative financial or investment products that can provide steady and sustainable income streams, especially those tailored to long-term retirement goals.

- Get expert advice: Consult with financial planners who can help you create a personalized strategy to maximize your financial readiness. Manulife’s trusted financial solutions and expert guidance have helped many customers significantly improve their retirement outcomes over the years.

- Adjust your strategy at every life stage:

- If you are a young adult (25-34), start investing early to maximize the growth potential of your investments. By focusing on higher-growth assets, you can set yourself up for success later on

- If you are a middle-aged working professional (35-54), it is important for you to balance growth with stability. Diversify your portfolio with a mix of sustainable income-generating and growth-focused assets to meet both short-term responsibilities and long-term retirement goals. Regularly review your financial plan to adapt to changes in your life stage, health, and aspirations.

- If you are an older adult nearing retirement (55+), focus on maintaining financial resilience as you approach retirement. With people living longer, staying invested can support your independence and help manage inflation and unexpected costs. Look for strategies that provide steady income while protecting your savings for the future. Remember, the journey to a fulfilling retirement is unique for everyone. Taking small, proactive steps now can lead to a more comfortable and enjoyable future.

For the Asia-specific data version, please visit this link.

If you liked this study, you may find these interesting

-

Enjoy a Better Life with These 5 Financial Tips

Read moreAll kinds of goals—whether short-term or long-term, require smart saving and financial security. Here are a few ways to save money while enjoying life!

-

Guaranteed Savings for Your Long-term Goals

Read morePlanning for our dreams can be complicated and overwhelming. Defining your short-term and long-term goals is essential to achieving success and personal satisfaction.

-

Secure Your Family’s Future by Saving Up Today

Read moreHow can you achieve peace of mind while providing for your family and reaching your life goals? Read to find out.