What is Manulife Asia Care Survey?

Started in 2020, Manulife’s Asia Care Survey is an annual research study that explores the evolving behavior, sentiments and priorities of people from eight markets in Asia (Mainland China, Hong Kong, Indonesia, Japan, Malaysia, Philippines, Singapore, and Vietnam) against the backdrop of volatile economic and sociopolitical realities impacting their financial goals, aspirations, and overall well-being.

This year's survey findings reveal a significant shift in priorities among consumers, emphasizing quality of life over lifespan. Filipinos surveyed prioritize health and financial independence to enjoy a better life over merely living a long, illness-free life. The survey also highlights the perceived importance of financial stability in maintaining overall health and quality-focused longevity. This underscores the importance of wellbeing in physical, mental, social, and financial aspects.

This evolving definition of longevity highlights the need for proactive engagement and support to help individuals make informed decisions and adopt behaviors aligning with their life goals. The survey also reveals a variety of approaches to planning for the future, indicating a broader opportunity for collaboration in guiding and empowering consumers to track progress and achieve a fulfilling, independent lifestyle in their later years.

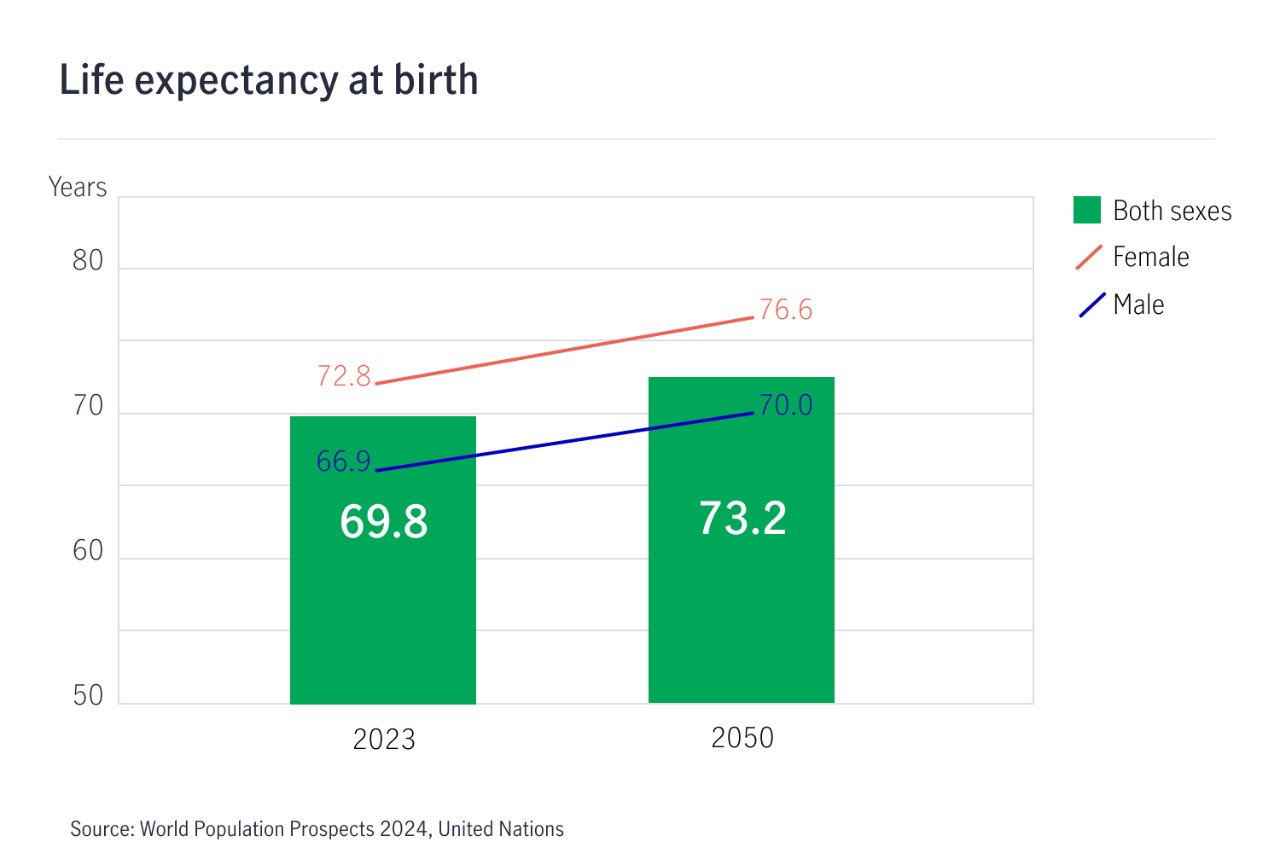

This year’s Asia Care survey asked 1,000 Filipinos about their views on longevity. In the Philippines, life expectancy at birth is projected to reach 73 years by 2050, from 70 years in 2023. As people live longer, they start viewing longevity from a different lens, which focuses on meeting their own needs and priorities.

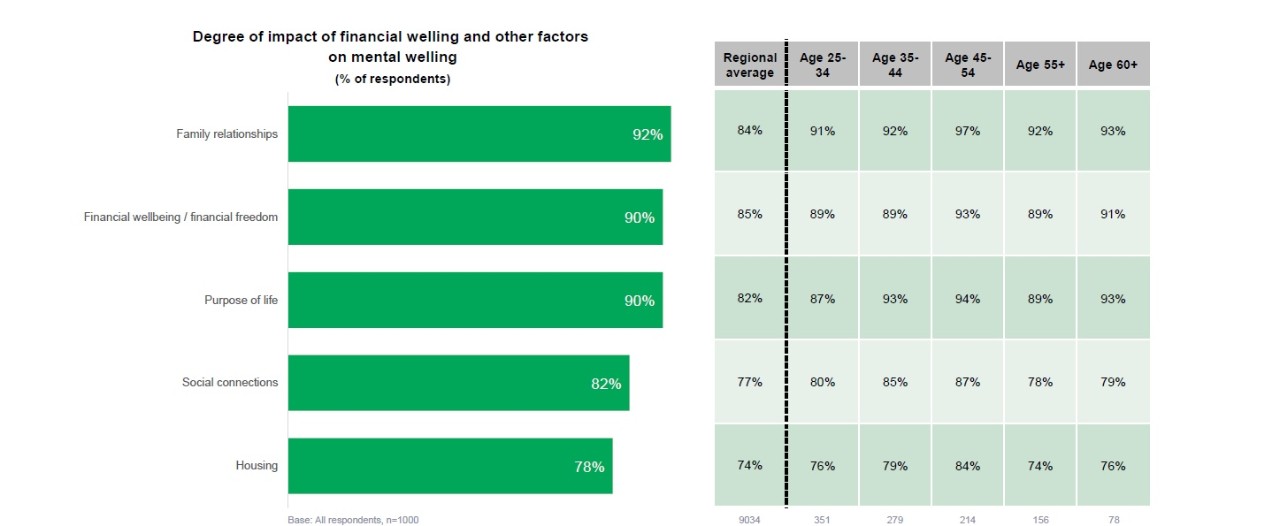

About 4 in 5 surveyed Filipino consumers believe their financial wellbeing has great impact on their health span (both physical and mental) and lifespan. In fact, wealth or financial wellbeing is believed to be as great as family relationships on mental health.

However, despite this awareness level, the average retirement savings among Filipinos is only PHP 630,000—16% of the PHP 3.85 million they estimate they will need to retire comfortably.